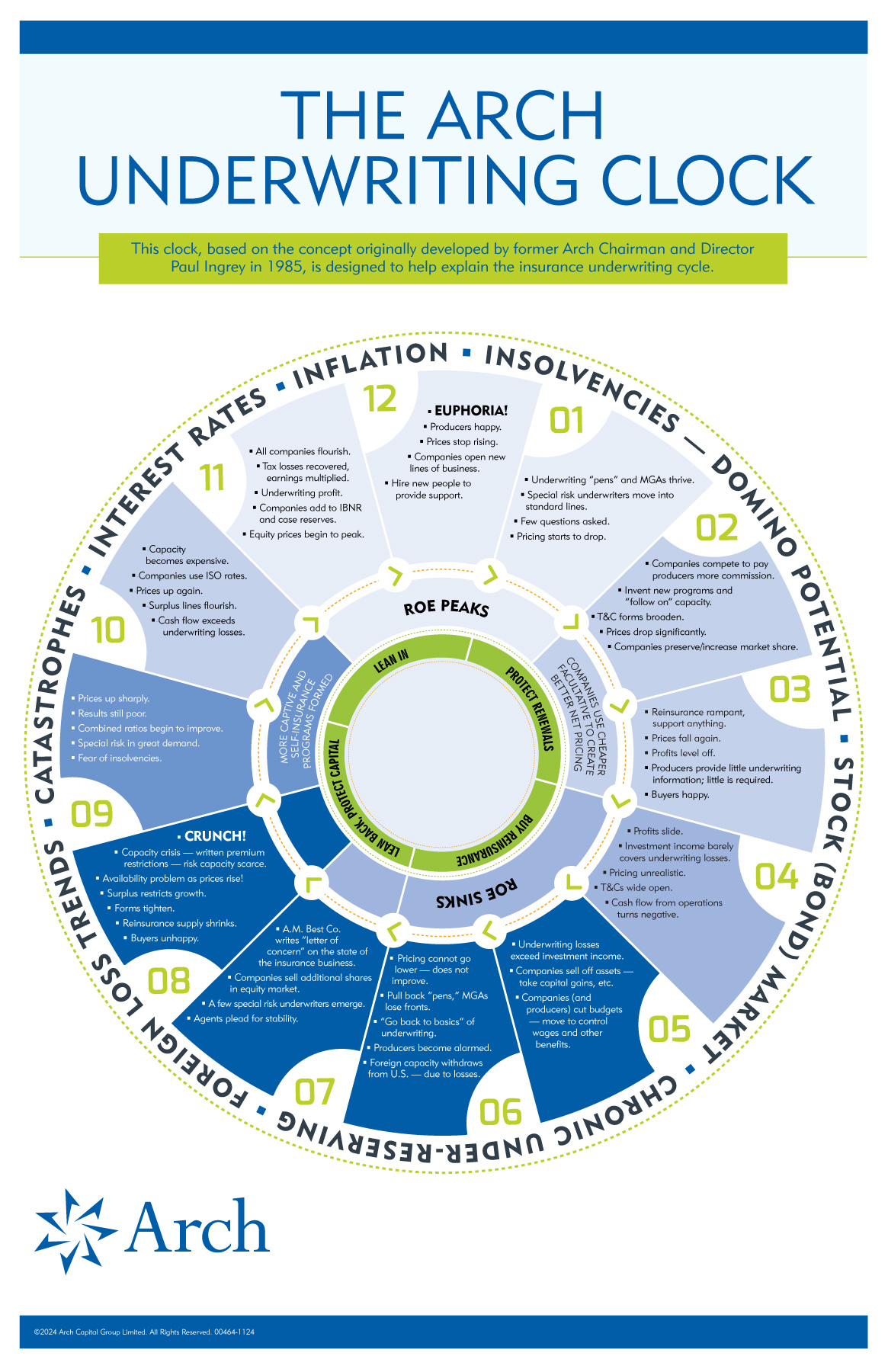

This clock, based on the concept originally developed by former Arch Chairman and Director Paul Ingrey in 1985, is designed to help explain the insurance underwriting cycle.

[Around the outside of the round clock, beginning at the top:]

Variables:

- Insolvencies—Domino potential

- Stock (Bond) market

- Chronic Under-reserving

- Foreign loss trends

- Catastrophes

- Interest rates

- Inflation

[Arranged as numbers on a clock:]

12

- EUPHORIA!

- Producers happy.

- Prices stop rising.

- Companies open new lines of business.

- Hire new people to provide support.

01

- Underwriting “pens” and MGAs thrive.

- Special risk underwriters move into standard lines.

- Few questions asked.

- Pricing starts to drop.

02

- Companies compete to pay producers more commission.

- Invent new programs and “follow on” capacity.

- T&C forms broaden.

- Prices drop significantly.

- Companies preserve/increase market share.

03

- Reinsurance rampant, support anything

- Prices fall again.

- Profits level off.

- Producers provide little underwriting information; little is required.

- Buyers happy.

04

- Profits slide.

- Investment income barely covers underwriting losses.

- Pricing unrealistic.

- T&Cs wide open.

- Cash flow from operations turns negative.

05

- Underwriting losses exceed investment income.

- Companies sell off assets—take capital gains, etc.

- Companies (and producers) cut budgets—move to control wages and other benefits.

06

- Pricing cannot go lower—does not improve.

- Pull back “pens,” MGAs lose fronts.

- “Go back to basics” of underwriting.

- Producers become alarmed.

- Foreign capacity withdraws from U.S.—due to losses.

07

- A.M. Best Co. writes “letter of concern” on the state of the insurance business.

- Companies sell additional shares in equity market.

- A few special risk underwriters emerge.

- Agents plead for stability.

08

- CRUNCH!

- Capacity crisis—written premium restrictions—risk capacity scarce.

- Availability problem as prices rise!

- Surplus restricts growth.

- Forms tighten.

- Reinsurance supply shrinks.

- Buyers unhappy.

09

- Prices up sharply.

- Results still poor.

- Combined ratios begin to improve.

- Special risk in great demand.

- Fear of insolvencies.

10

- Capacity becomes expensive.

- Companies use ISO rates.

- Prices up again.

- Surplus lines flourish.

- Cash flow exceeds underwriting losses.

11

- All companies flourish.

- Tax losses recovered, earnings multiplied.

- Underwriting profit.

- Companies add to IBNR and case reserves.

- Equity prices begin to peak.

[Inside the circle, toward its center and beginning at the top:]

- ROE Peaks

- Companies use cheaper facultative to create better net pricing.

- ROE Sinks.

- More Captive and self-insurance programs formed.